Guidelines

Tuesday, May 17, 2022

What are the Actual, Historic Amounts Collected by the BCC for our 1 Cent and 1/2 Cent Sales Taxes?

Friday, May 13, 2022

Mythology versus Reality on Sales Tax Referendum versus Higher Property Taxes to Pay for Fire......

|

| Separate facts from mythology if you want to make a cogent argument against everyone sharing in the shouldering of a tax to pay for fire service |

Some folks are already attempting to shoot holes through the idea of a sales tax based system for funding fire protection in Escambia County. They are implying it would harm those who are poor and struggling to pay for food.

But sales taxes are not applied to groceries. Groceries are exempt. To say otherwise is untrue.

Gas is also exempt from this particular sales tax. (Don't get me wrong--each gallon of gas is LOADED UP with all kinds of Federal, State, and some Local taxes---but this particluar sales tax is not applied and would not be applied--so this change, in and of itself, will not make gas more expensive for poor people) To say otherwise is untrue.

Other necessary purchases that are subject to taxation that are important to all citizens, (wealthy/middle class/poor)-- such as back to school supplies or hurricane supplies--are frequently given sales tax amnesty periods where no state taxes are applied to applicable purchases. So with proper planning--- even those sales taxes can be avoided by all consumers in Escambia County.

Yes--big ticket items like automobiles, appliances, furniture--yes these carry a sales tax burden. But often these taxes can be rolled into the financing deal or a discount equal to sales taxes can be negotiated.

Yes--retail and big ticket purchases are subject to sales tax. That means if someone is "POOR" and they spend, say, $5,000 a month on non-exempt retail purchases, the total additional sales taxes they would pay if this proposal for a half-penny moves forward by the voters, would be............insert sound of drumroll............ ($25 dollars extra). (Most truly poor individuals won't even spend $5,000 per YEAR on cash money purchases subject to full taxation--when all exempt purchases they make are taken out of the equation.....)

Here's a couple of newsflashes:

1. If you are spending $5,000 per month (equalling 60K Yearly) on sales tax applicable non-exempt retail merchandise you probably do not meet any rational definition of "poor."

2. If you still, somehow, feel as though you are "poor" and yet can afford to spend $5,000 per month

Sunday, October 26, 2014

One Group Wants Voters to Say "NO" to the 1/2 Cent Sales Tax Ballot Initiative

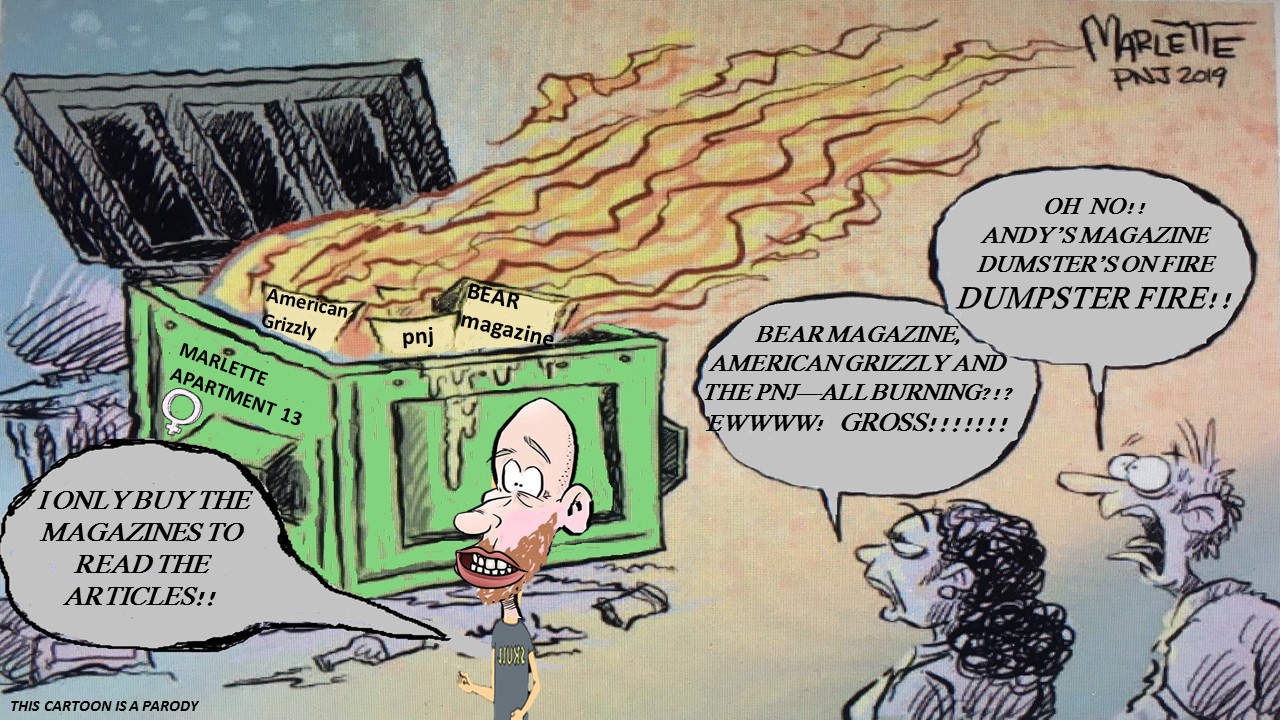

Sometimes I get emails that make me scratch my head and say "Why?"

This email came, and the logic seems absent. I'm confounded by the lack of logic, actually.

The most expensive school built in Escambia County, in the last two decades, was built downtown and serves 98% African American students. It is a state of the art facility that replaced two aging facilities

The newly rebuilt Ernest Ward Middle school, funded by the 1/2 cent sales tax, serves a significant number of African American students.

So why is this group attempting to sabotage the vote to renew our 1/2 cent sales tax referendum? I'm scratching my head because a lot of African American students in Escambia County benefit from this funding source.

If the referendum does not pass, this will eventually serve to negatively affect the African American students in our county, as well as all the other students.....

Sad that people don't get that reality.