|

| EDATES allow the county to give valuable incentives to targeted industries in exchange for job-creation and footprint expansion. This is not a bad thing, this is a GOOD THING! |

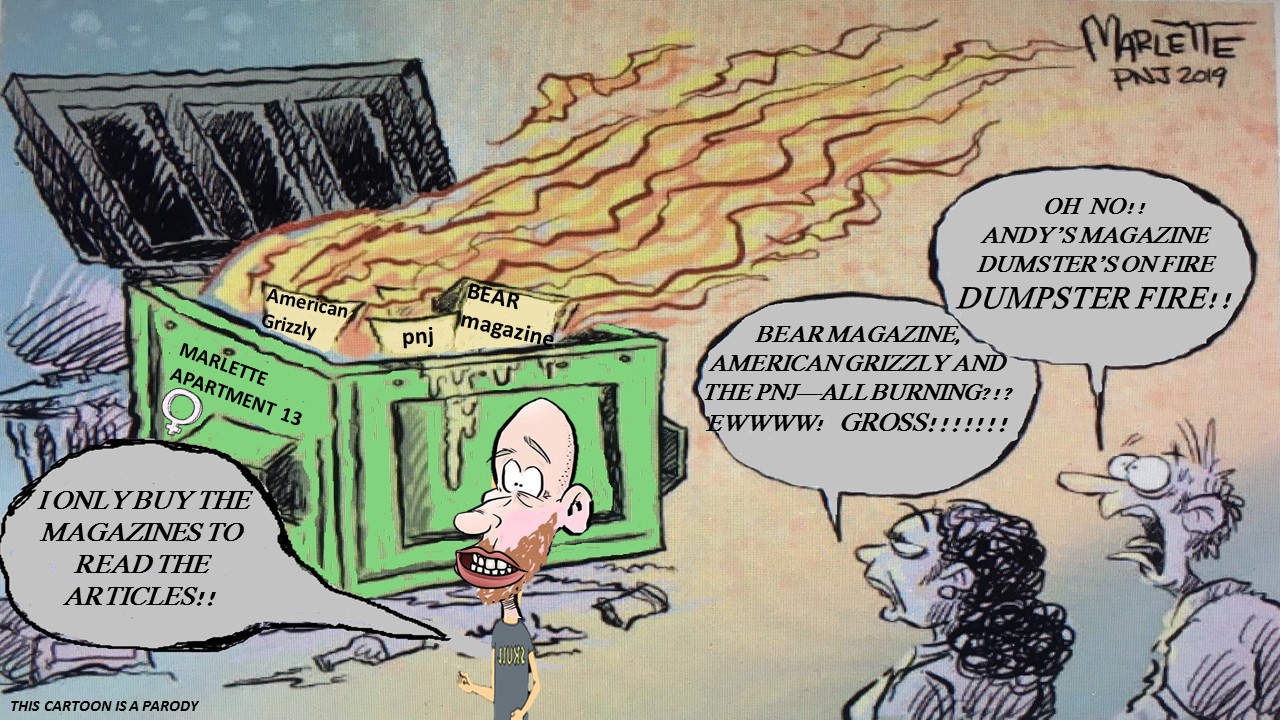

In part one of this series I talked about the recent baseless and ignorant attacks on EDATES from the local media.

In this post, I want to talk specifics about EDATES....who gets them locally, what it costs the taxpayers in unrealized ad valorem revenue, and the value created by the BCC approving these agreements.

The complete list of all recipients of EDATES locally are contained on the spreadsheets here, here, here, and here. The spreadsheets, provided to me by the county's budget and finance department, highlight the areas where we exempt taxes; County, Library MSBU, and the Sheriff's MSTU. In the header of the vertical columns, you will see the value of the subject property to be exempted, expressed in three ways:

1. Market Value of the Property

2. Assessed Value of the Property

3. The Amount of the total Assessed Value that will be Exempted via the EDATE

At the far right, the value of the exemption received is listed, and at the bottom of the sheet the grand total of all exemptions is listed. For the four years I have included, the average yearly total of these exemptions given (which equates to the unrealized tax revenue)-is roughly $1.7 Million Annually.

Some things to consider when looking at EDATES as an economic development tool:

1. The period of the incentive is capped at 10 years, after which time full tax is paid on full taxable value of real property.

2. There is a ying and a yang to these agreements; something is given by the county, and for that something is given by the entity receiving the EDATE (additional jobs commitments usually)

3. The local School Board receives full tax revenue on the full taxable value of properties that the County provides EDATES to, from day one of the agreement (school taxes cannot be diminished via EDATES under statute, and neither can the Fire MSBU)

4. The county does not have to give EDATE exemptions on the full amount of the taxable value of a property; the BCC can give an exemption on a portion of the value and collect taxes on the rest--and this happens frequently.

Look over the list of recipients on the spreadsheets I have linked. These are good companies, that pay good wages and support thousands of jobs locally!

When IP received their EDATE in May of 2008 (before any current member of the BCC was on the board)--it was given in exchange for a massive expansion of their production and an investment of over $200 Million dollars to their plant. It was supported unanimously at the time, and signed by my predecessor's predecessor, Mike Whitehead, then chairman of the board and D1 Commissioner. It did give IP an exemption of roughly $1.6 Million yearly for 10 years. And this exemption has expired as of 1/1/2018. With IP supporting 500 personnel and 100 contractor personnel and having an economic impact in our area that is calculated to be $250 Million annually over the last ten years--I believe what the BCC did in 2008 was a good move----especially given the dire circumstances nationally that were occurring at that time....Someone should wake up and remind the local media personalities about the great recession of 2008 that served as a backdrop to this BCC decision of 2008, and tell them it's easy to play Monday morning quarterback but not easy to make tough decisions in real time--and this is what distinguishes the "doers" (us) from the "pundits" and "gadflys" and "critics" (them).

No comments:

Post a Comment